In a world where giving back is more important than ever, finding the most effective way to maximize your impact can be a daunting task. When it comes to charitable donations, there are a plethora of options available, from tax deductions to gift cards. But which is the right choice for you? Let’s delve into the pros and cons of each, helping you navigate the complex landscape of giving with confidence and clarity.

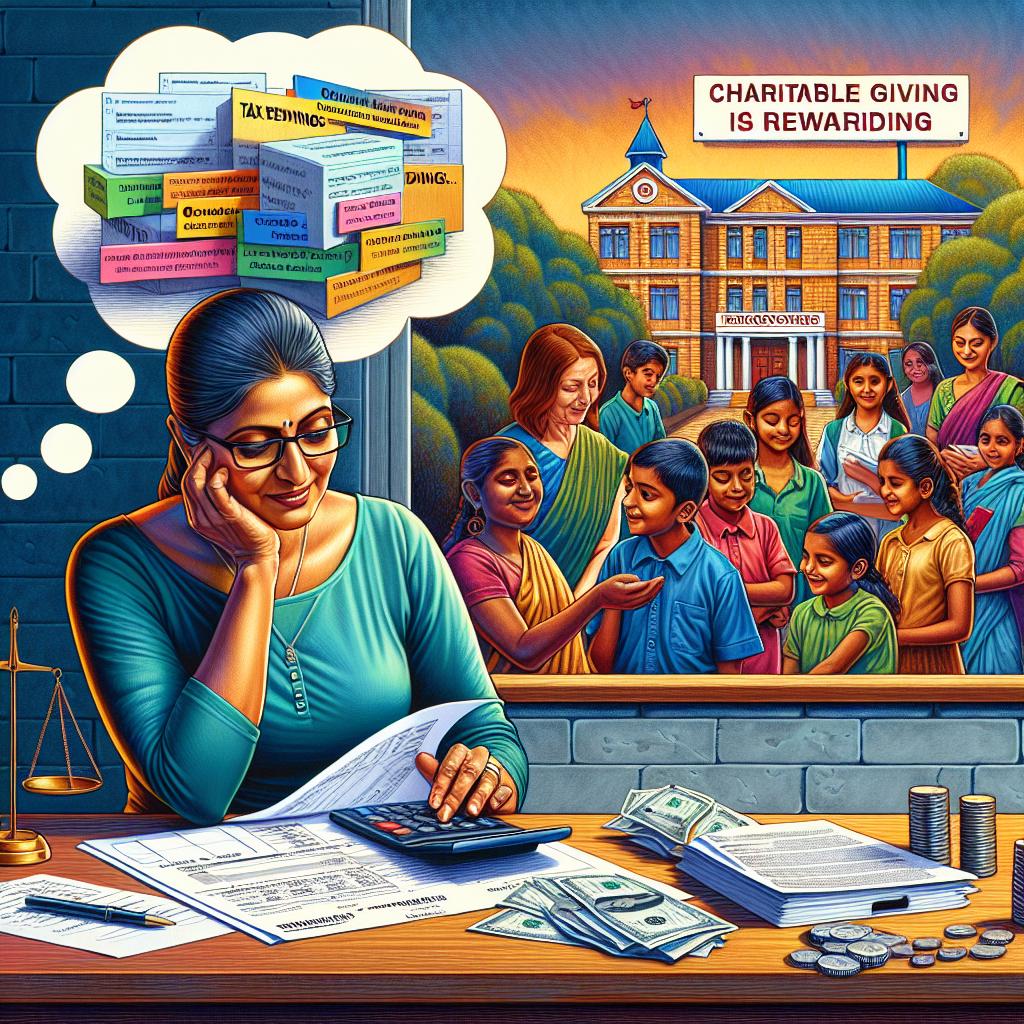

Benefits of Tax Deductions for Charitable Giving

When it comes to maximizing your charitable giving, tax deductions can play a crucial role in helping you make the most impact with your donations. By taking advantage of tax deductions for charitable giving, you can lower your taxable income and potentially reduce the amount you owe in taxes. This means that for every dollar you donate to a qualifying charity, you may be able to save money on your tax bill.

On the other hand, gift cards can also be a convenient way to give to those in need, allowing recipients to choose their own items or services. However, unlike tax deductions, gift cards do not come with the same financial benefit of reducing your taxable income. the decision between using tax deductions or gift cards for charitable giving will depend on your personal financial goals and whether you value the tax benefits that come with giving to charity.

Understanding the Pros and Cons of Gift Cards for Donations

When it comes to making charitable donations, many people are faced with the decision of whether to give cash or use gift cards. Both options have their pros and cons, so it’s important to weigh them carefully before making a decision. Gift cards can be a great way to give back to those in need while also giving the recipient the flexibility to choose what they need most. Plus, giving gift cards can be a more personal and thoughtful way to show someone you care. However, it’s important to keep in mind that not all charities accept gift cards, so be sure to check with the organization before making your donation.

On the other hand, making a cash donation can provide you with a tax deduction, which can help lower your tax bill at the end of the year. This can be especially beneficial if you’re looking to maximize your giving and take advantage of all available tax deductions. Additionally, cash donations are typically more straightforward and easier for charities to process than gift cards. Ultimately, the right choice will depend on your own personal preferences and financial situation, so take the time to consider all the factors before making a decision.

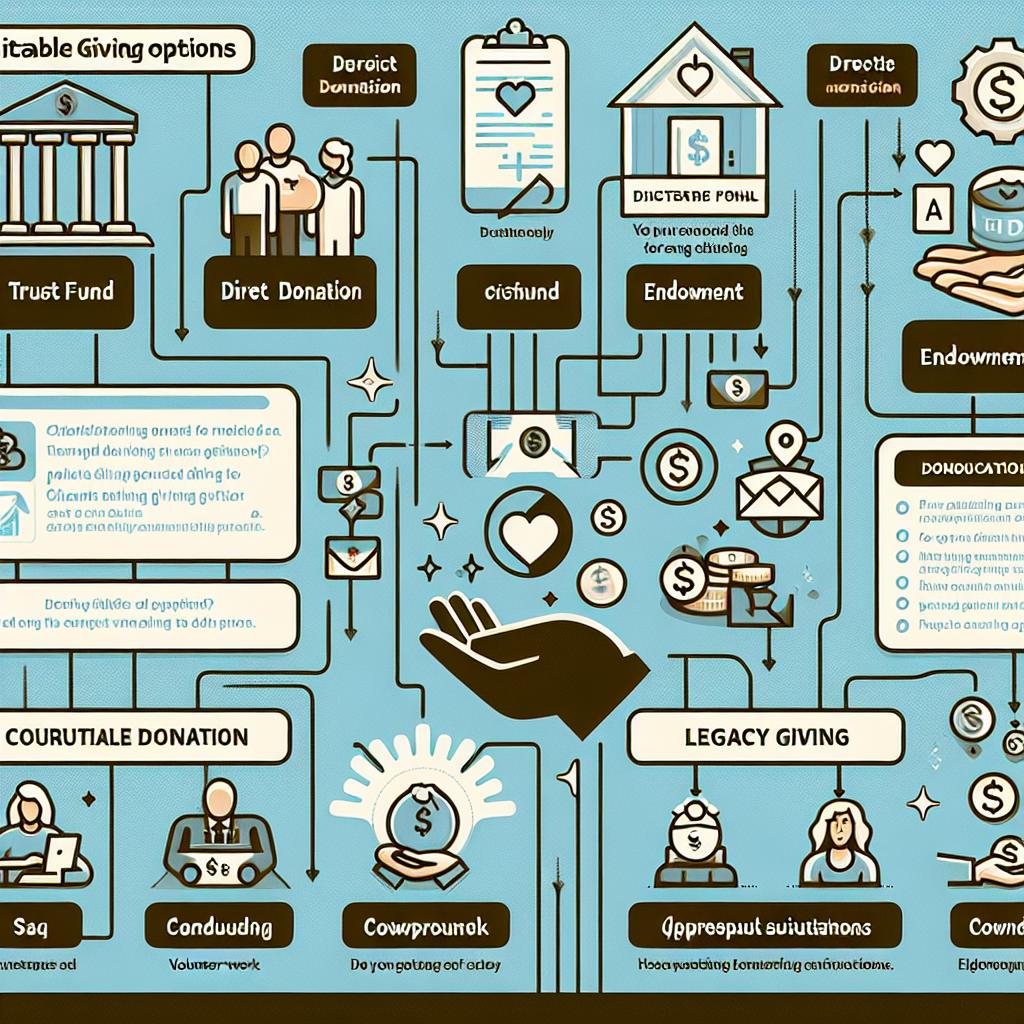

Tips for Choosing the Right Giving Option for Your Situation

When deciding between tax deductions and gift cards for your charitable giving, it’s important to consider your individual financial situation and philanthropic goals. One option to consider is maximizing your tax deductions by donating appreciated assets such as stocks or real estate. By donating assets that have increased in value, you may be able to avoid capital gains taxes and receive a charitable deduction for the full fair market value of the asset.

On the other hand, gift cards can be a convenient and flexible giving option, allowing you to support your favorite charities while also giving the recipient the freedom to choose where they’d like to donate. Gift cards are a great way to involve friends and family in your charitable giving, as they can be easily shared and used by multiple individuals. Additionally, gift cards can be a great option for last-minute gifts or for those who prefer to support a variety of causes.

The Way Forward

When it comes to maximizing your giving, whether through tax deductions or gift cards, the decision ultimately comes down to your personal preferences and financial situation. Both options offer their own benefits and drawbacks, so it’s important to weigh your choices carefully. Whether you choose to take advantage of tax deductions or opt for the convenience of gift cards, know that your generosity is making a difference in the lives of others. So keep on giving, in whatever way feels right for you. Thank you for taking the time to consider how you can make a positive impact through your gifts.